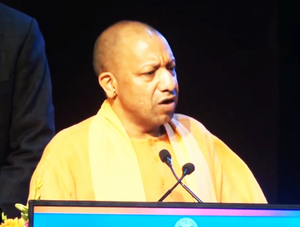

Lucknow, March 3 (IANS) To foster entrepreneurship among the youth of Uttar Pradesh, Chief Minister Yogi Adityanath will soon launch his ambitious scheme, ‘Mukhyamantri Yuva Udyami Vikas Abhiyan’ (MYUVA), soon.

The chief minister has directed officials of the Micro, Small, and Medium Enterprises (MSME) Department to promptly devise a comprehensive action plan for the initiative and submit it to the government as soon as possible.

Under this scheme, the state government aims to prepare one lakh young entrepreneurs every year by providing interest-free loans for projects of up to Rs 5 lakh. The government has allocated Rs 1,000 crore in the budget for the financial year 2024-25 to support this initiative.

According to the government spokesman, this innovative scheme is designed to empower educated and skilled youth across the state, facilitating self-employment opportunities and fostering the establishment of new MSMEs.

By promoting entrepreneurship, the initiative seeks to generate employment opportunities in both rural and urban areas.

Under the scheme, interest-free loans of up to Rs 5 lakh will be provided to projects in the industry and service sectors. The goal is to directly benefit one million units over the next 10 years by financing 1,00,000 units annually.

Beneficiaries who have undergone training in various government-run schemes, such as the Vishwakarma Shram Samman Yojana, One District One Product Training and Toolkit Scheme, Scheduled Caste, Tribe, Other Backward Class Training Scheme, and Skill Upgradation (Kaushal Unnayan) run by the Uttar Pradesh Skill Development Mission, will be eligible for assistance.

Youth having certificates, diplomas, and degrees from educational institutions will also be entitled to benefits under this scheme.

Upon successful repayment of the first loan, units will be eligible for second-stage financing, where a composite loan of double the initial amount or up to Rs 7.50 lakh can be provided. Furthermore, arrangements for grants have also been made to promote digital transactions.

The application process for the scheme will be conducted online. In this, Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) coverage will be provided to all loans received from banks and financial institutions. Funding for this scheme will be available from nationalised, scheduled, rural banks, SIDBI and all financial institutions notified by the Reserve Bank of India, the spokesman said.

–IANS

amita/uk

Disclaimer

The information contained in this website is for general information purposes only. The information is provided by TodayIndia.news and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of TodayIndia.news We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, TodayIndia.news takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

For any legal details or query please visit original source link given with news or click on Go to Source.

Our translation service aims to offer the most accurate translation possible and we rarely experience any issues with news post. However, as the translation is carried out by third part tool there is a possibility for error to cause the occasional inaccuracy. We therefore require you to accept this disclaimer before confirming any translation news with us.

If you are not willing to accept this disclaimer then we recommend reading news post in its original language.