· RE target for 2030 revised upwards to 50 GW from 45 GW

· Greenfield capacity addition of 2.8 GW in FY24, representing 15% of India’s total renewable energy capacity addition

· Run-rate EBITDA stands at a strong Rs. 10,462 crore; Net Debt to Run-rate EBITDA at 4.0x v/s 5.4x last year

Chandigarh/Ahmedabad, 3 May 2024: Adani Green Energy Ltd (AGEL), India’s largest and fastest growing pure-play renewable energy company, today, announced financial results for the quarter and year ending 31 March 2024.

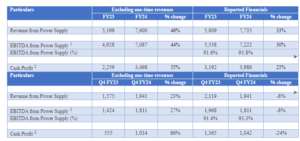

FINANCIAL PERFORMANCE – FY24:

The robust growth in revenue, EBITDA and cash profit is primarily driven by capacity addition of 2,848 MW over the last year, consistent capacity utilization factor (CUF) for solar portfolio and improved CUF for wind and solar-wind hybrid portfolio.

Ø The Run-rate EBITDA stands at a strong Rs. 10,462 crore with Net Debt to Run-rate EBITDA at 4.0x as of March 2024 as compared to 5.4x last year.

Mr. Amit Singh, Chief Executive Officer, Adani Green Energy Ltd, said, “I am immensely proud of the team for successfully deployed the first 2 GW of the 30 GW of renewable capacity under construction at Khavda in just 12 months of breaking ground. Our highest capacity addition of 2.8 GW in FY24 demonstrates our strong execution capabilities, and we are confident of continuing the momentum. Aligned with the country’s need for accelerated integration of renewables into the grid, we are now focused on delivering energy storage in addition to solar, wind, and hybrid projects. Our goal is to commission at least 5 GW of hydro pumped storage projects by 2030. We remain steadfast in our commitment to deliver affordable clean energy at an unprecedented scale and velocity and have set a higher target of 50 GW by 2030, which will contribute towards India’s non-fossil fuel capacity target of 500 GW.”

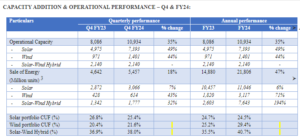

CAPACITY ADDITION & OPERATIONAL PERFORMANCE – Q4 & FY24:

AGEL’s operational capacity grew at 35% YoY to 10,934 MW with greenfield addition of 2,848 MW renewable capacity including 2,418 MW solar and 430 MW wind projects. With this. AGEL became the first company in India to cross the 10,000 MW renewable energy capacity. AGEL’s 10,934 MW operational portfolio will power more than 5.8 million homes and avoid about 21 million tonnes of CO2 emissions annually.

Ø AGEL is developing the world’s largest renewable energy project of 30,000 MW on barren land at Khavda in Gujarat. Spread across 538 sq km, it is five times the size of Paris. Within just 12 months of breaking ground, AGEL has operationalized 2,000 MW. AGEL is deploying the latest renewable energy technologies such as n-type bifacial solar modules and India’s largest 5.2 MW wind turbine maximizing energy generation and minimizing the levelized cost of electricity. AGEL is setting a precedent for how innovative technology, execution capabilities, digitization, a robust supply chain network, and long-term infrastructure financing, combined with sustainable practices, can drive the clean energy transition and decarbonization on a giga scale.

Ø The sale of energy increased by 47% YoY to 21,806 million units in FY24 primarily backed by strong capacity addition, consistent solar CUF and improved wind and hybrid CUF.

Ø The solar portfolio CUF remained consistent at 24.5% in FY24 with improved plant and grid availability while the solar irradiation was relatively lower.

Ø The wind portfolio CUF improved by 420 bps YoY to 29.4% in FY24 with improved plant availability, grid availability and wind speed.

Ø The solar-wind hybrid portfolio CUF improved by 520 bps YoY to 40.7% in FY24 backed by higher CUF profile projects commissioned in the second half of FY23 as well as improved plant and grid availability.

ESG UPDATES

Ø In March 2024, the Science Museum in London, UK, opened Energy Revolution: The Adani Green Energy Gallery, a major new gallery which explores how the world can generate and use energy more sustainably to urgently decarbonize to limit climate change. The gallery is sponsored by AGEL and through striking displays of contemporary and historic objects from the UK and abroad, interactive digital exhibits, and specially commissioned models, the gallery shows how the past, present and future are shaped by human imagination and innovation and explores how we all have a role to play in deciding our energy future.

Ø AGEL is rated ‘A-’ in CDP Climate Change 2023 assessment displaying environmental leadership. Further, AGEL has been rated in the top most category ‘A’ in the CDP supplier engagement rating 2023.

Ø AGEL is ranked 1st in Asia and amongst top 5 companies in RE sector globally in latest ESG assessment by ISS ESG and placed in prime ‘B+’ band for robust ESG practices and displaying very high level of transparency.

OTHER KEY RECENT MILESTONES:

Ø AGEL has completed refinancing of its existing Restricted Group 1 bond, which was due in December 2024, with fresh issuance of new bonds for an aggregate amount of USD 409 mn. The issue was oversubscribed by 6.5 times and we achieved a pricing of 6.7%, well below the trading bond yield of existing bond. The bond is an amortizing structure bond with 18 years of tenure closely matching the project cashflows thereby de-risking the debt servicing.

Ø AGEL has commenced construction work on its first hydro pumped storage project (PSP) of 500 MW on the Chitravathi river. The project is located at Peddakotla in Sri Sathya Sai district of Andhra Pradesh. The existing reservoir will act as the lower reservoir and the upper reservoir is to be developed. The generation capacity will be 500 MW with estimated 6.2 generation hours in a day. All necessary approvals including the final DPR approval are in place and financial closure has been achieved for the project.

AGEL has a development pipeline of hydro pumped storage projects across Andhra Pradesh, Maharashtra, Tamil Nadu and Telangana. In the first phase, AGEL plans to develop 5 GW+ PSP capacity by 2030.

With this, AGEL’s renewable energy capacity target is now revised upwards to 50 GW by 2030. AGEL is committed to lead large-scale renewable energy deployment with an increasing focus on storage solutions for an accelerated integration of renewables into the grid thereby helping the country move closer to its non-fossil fuel target of 500 GW by 2030.

Disclaimer

The information contained in this website is for general information purposes only. The information is provided by TodayIndia.news and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of TodayIndia.news We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, TodayIndia.news takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

For any legal details or query please visit original source link given with news or click on Go to Source.

Our translation service aims to offer the most accurate translation possible and we rarely experience any issues with news post. However, as the translation is carried out by third part tool there is a possibility for error to cause the occasional inaccuracy. We therefore require you to accept this disclaimer before confirming any translation news with us.

If you are not willing to accept this disclaimer then we recommend reading news post in its original language.