Key Highlights in FY24

1. Board of Directors have recommended a dividend of Rs. 3.60 per equity share (36%

of face value of Rs.10 per equity share) for the year ended March 31, 2024 subject

to requisite approvals.

2. Strong Financial Performance:

Net Profit of the Bank increased by 61.84% on YoY basis during FY24. Net interest income

of Bank grew by 11.61% on YoY basis during FY24.

3. Bank continues to demonstrate a strong Liability franchise:

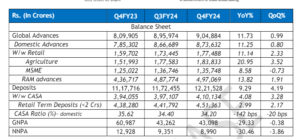

Domestic deposits have increased by 8.42% YoY. Bank now have a total deposits base of

Rs.12,21,528 Crores as on March 31, 2024.

4. Business Growth gaining momentum:

Total Business of the Bank increased by 10.31% YoY, wherein Gross Advances increased

by 11.73% YoY & Total Deposit grew by 9.29% YoY. Bank has a total Business of

Rs.21,26,412 Crores as on March 31, 2024.

5. Growth in Retail, Agri and MSME (RAM) segments:

RAM Segment of the Bank increased by 13.82% YoY, where 11.14% growth in Retail,

20.95% growth in Agriculture and 8.58% growth in MSME advances is achieved on YoY

basis. RAM advances as a percent of Domestic Advances stood at 56.90%.

6. Reduction in NPA:

Gross NPA (%) reduced by 277 bps on YoY basis to 4.76% and Net NPA (%) reduced by

67 bps on YoY basis to 1.03% as on 31.03.2024.

7. Strong Capital Ratios:

CRAR improved from 16.04% as on 31.03.2023 to 16.97% as on 31.03.2024. CET1 ratio

improved to 13.65% as on 31.03.2024 from 12.36% as on 31.03.2023.

8. Improved Returns:

Bank’s Return on Assets & Return on Equity improved to 1.03% and 15.58% respectively

during FY24.

Network:

8,466 Branches including foreign branches

8,982 ATMs

19,603 BC points

135 MLPs (MSME Loan Points)

159 RLPs (Retail Loan Points)

42 ALPs (Agriculture Loan Points)

105 Union MSME First Branches

1,685 Gold Loan Points

19 LCBs & 40 MCBs

8 SAMBs & 30 ARBs

Financial Inclusion schemes:

Financial Inclusion schemes launched by GOI with an aim to eliminate barriers and provide

economically priced financial services to the less accessible sections of the society through

government-backed schemes like PMJJBY, PMSBY, PMJDY and APY.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY):

This is a Government- backed insurance scheme; where 3.00 lakhs new enrollments were

done by the Bank for the quarter ended March 31, 2024.

Pradhan Mantri Suraksha Bima Yojana (PMSBY):

This is Government- backed accidental insurance scheme; where 7.83 lakhs new

enrollments were done by the Bank for the quarter ended March 31, 2024.

Pradhan Mantri Jan Dhan Yojana (PMJDY):

Our bank is instrumental in opening 2.95 Crores accounts under PMJDY Scheme with

balance of Rs. 10,918 Crores as on 31.03.2024. The corresponding figure was 2.80 Crores

account with balance of Rs. 9,046 Crores as on 31.03.2023.

Atal Pension Yojana (APY):

APY is a pension scheme, primarily targeted at the individuals working in unorganized

sector, 2.00 lakh new enrollments were done by Bank for the quarter ended

March 31, 2024.

Union Nari Shakti Scheme for Women Entrepreneurs:

Sanctioned 22,676 Applications for Rs.2,555 crores during 12M FY24

Credit facility towards Green initiatives: –

1) Renewable Energy Sector: -Sanctioned Rs. 23,059 crores as on 31.03.2024

2) Union Green Miles: -Sanctioned amount Rs. 462 crores as on 31.03.2024

Date: May 10, 2024

Place: Mumbai

Disclaimer

The information contained in this website is for general information purposes only. The information is provided by TodayIndia.news and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of TodayIndia.news We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the website up and running smoothly. However, TodayIndia.news takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

For any legal details or query please visit original source link given with news or click on Go to Source.

Our translation service aims to offer the most accurate translation possible and we rarely experience any issues with news post. However, as the translation is carried out by third part tool there is a possibility for error to cause the occasional inaccuracy. We therefore require you to accept this disclaimer before confirming any translation news with us.

If you are not willing to accept this disclaimer then we recommend reading news post in its original language.